22.5 Decision Tree Pathway report

The Decision Tree Pathway report allows you to follow the calculations within a model strategy. Specifically, you can track the following:

-

Probability of reaching each node (path probability).

-

Accumulation of value(s) at each node.

-

Rollback calculations by node.

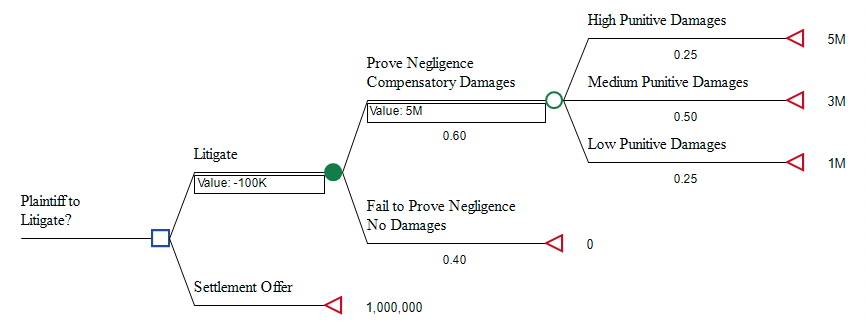

We will use the Legal tutorial example, LegalTree-UpstreamPayoffs.trex to illustrate the details of the report. This model uses Upstream payoffs, which is described in section Entering Upstream Payoffs Along Patient Pathways.

To generate the report, you must first select a Strategy node, which is a branch of the primary decision node for the model. In this model, there are two strategy nodes - Litigate or Settlement Offer.

With a strategy node selected (Litigate), choose Analysis > Decision Tree Pathway Report from the menu.

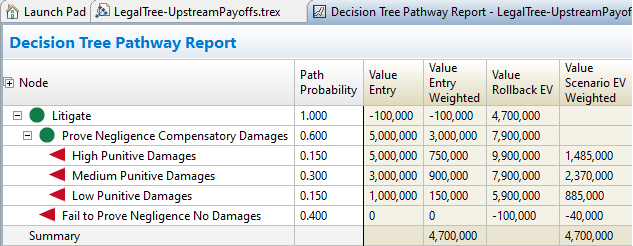

Node & Probability Columns

The first two columns of the report illustrate movement through the strategy's pathways.

-

Node: the label for each node within the strategy

-

Path Probability: the probability of reaching that node

The strategy node itself will always have the full probability of 1. From there, the probability of reaching each node is dependent on all the probabilities along its path.

For example, there is a 0.60 probability of proving negligence, so the probability of reaching the Prove Negligence node is 0.6. Further downstream, there is a 0.25 probability of High Punitive Damages, so the probability of reaching that node is 0.6 * 0.25 = 0.15.

Value Columns

For each enabled payoff, four columns will be displayed. In this model, the payoff label is “Value”, which is included in each column label.

-

Value Entry: the payoff value accumulated at that node (if any)

-

Value Entry Weighted: the payoff value weighted by the probability of reaching that node (Value Entry * Path Probability)

-

Value Rollback EV: the value at that node calculated from rollback (working right-to-left from the terminal nodes)

-

Value Scenario EV Weighted: the weighted value of the scenario ending with a terminal node (Rollback Value * Path Probability)

The first two value columns illustrate the accumulation of value as you move from the strategy node to the terminal nodes (left to right in the model).

In the example model, legal fees of 100K are added at the Litigate node. This value is shown in the Value Entry column: -100K. The probability at the Litigate node is 1, so the Value Entry Weighted value is also -100K.

At the Prove Negligence node, compensatory damages of 5M are accumulated as seen in the Value Entry column. However, there is only a 0.6 chance of reaching that node (from the Cohort column), so the Value Entry Weighted is 0.6 * 5M= 3M.

At the High Punitive Damages node, there is another 5M in punitive damages (from the Value Entry column). The probability of reaching that node is only 0.15, so the Value Entry Weighted is 0.15 * 5M = 750K.

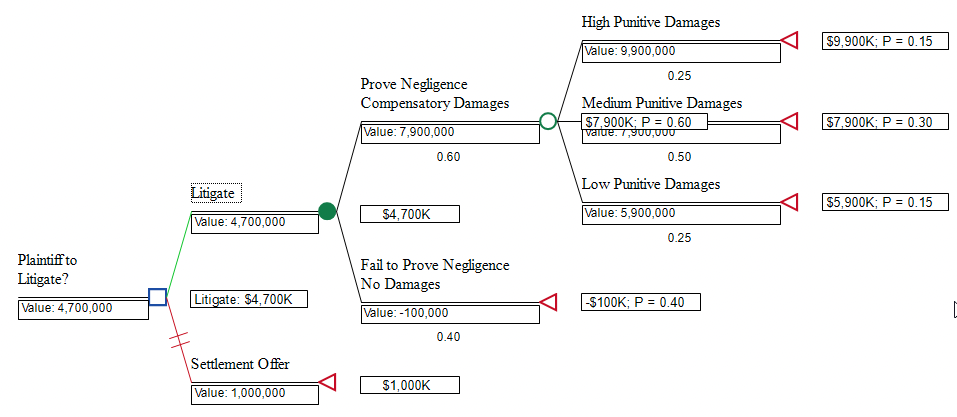

The third and fourth value columns illustrate rollback calculations working back from the terminal nodes to the strategy node (right-to-left in the model). The third Rollback Value column displays the expected value at each node in the model. These are the same values you would see directly in the model when Roll Back is on.

The fourth column is the weighted expected value of a scenario represented by its terminal node (Rollback Value * Cohort). The weighted values of all scenarios sum to the total value of the strategy.

In the example model, the Rollback Value column presents the expected value at that node. At a terminal node, this is the value of the complete pathway from the strategy node to the terminal node. At the High Punitive Damages node, the full value reflects: legal fees + compensatory damages + punitive damages (-100K + 5M + 5M = 9.9M).

Further upstream at the Prove Negligence Node, the Rollback Value is the weighted average of all the node's branches to its right (0.25*9.9M + 0.5*7.9M + 0.25*5.9M = 7.9M). Even further upstream at the Litigate node, the Rollback Value is the weighted average from the Prove Negligence and Fail to Prove Negligence nodes (0.6*7.9M + 0.4*(-100K) = 4.7M).

The Value Scenario Impact column presents the weighted impact of that scenario on the entire strategy (for terminal nodes only). The High Punitive Damages node has a value of 9.9M, weighted by a probability of 0.15, yielding an impact value of 1.485M. The sum of the Value Scenario Impact of all four scenarios/terminal nodes generates the total value of the strategy (4.7M).

You can set a constant cohort size to your model, which will multiply all values in this report by that cohort size. Refer to the Roll back section for details.